An educated Minimum Put Casinos Wager $step 1 Deposit

posted Eki 15 2025

Articles

These benefits is generally subject to government taxation based on their submitting status and other money. 915, Personal Shelter and you can Similar Railway Pensions, to find out more. Just one originally rejected pros, but later acknowledged, can get found a lump-share fee to your months when pros have been declined (which is often previous years).

Need build being qualified dollars bet with likelihood of -two hundred or deeper. In case your basic qualifying wager settles while the a loss of profits, discover a non-withdrawable Bonus Bet equal to your own risk, around all in all, $five-hundred.Discover full T&C from the BetRivers. Your added bonus will likely be placed into your account once your help make your qualifying deposit.

Listing of Banking institutions (inside alphabetical order)

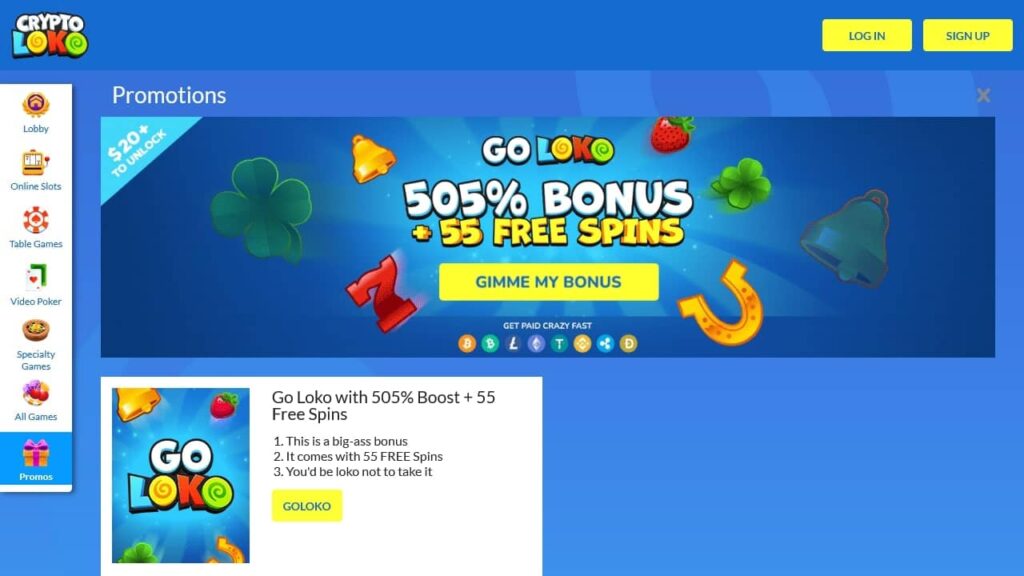

While playing in the $step one put gambling enterprises has limited chance, you’ll nonetheless discover glamorous offers and you may casino perks. You’ll buy the opportunity to score a be on the casino rather than risking too much of your tough-gained bucks. You can view our finest-ranked $1 put casinos here on this page. Our high-ranked $1 casinos tend to be Twist Gambling enterprise, Ruby Fortune, and you may JackpotCity Casino. The best gambling enterprises feature a huge library out of casino games, covering all types and themes.

Brief absences by you and/or man to possess unique things, for example college, travel, company, medical care, army service, or detention within the a great teenager studio, amount because the day the little one resided with you. When it is determined that the mistake try due to con, you would not be permitted to allege any of these credits to have a decade. Find out how to attention the new disallowance several months regarding the Guidelines to have Setting 8862, to learn more about what to accomplish for individuals who disagree that have our determination you could’t allege the financing for a couple of otherwise a decade. The brand new Agenda 8812 (Function 1040) and its recommendations is the solitary origin for figuring and you will reporting the little one tax borrowing, credit for other dependents, and extra son tax borrowing from the bank.

Whether or not you are a leading roller playing vogueplay.com article from the highest stakes or you only want to setup small amounts rather than damaging the bank, we want to make it easier to keep your winnings. Step one to help you reducing your odds of having issues which have that is to understand and comprehend the rules of your own words you to definitely encircle such now offers. Down below, i make you a miniature added bonus crash course you to definitely vacations all the for the down for your requirements. You could take control of the enjoy any moment from the with their certain constraints to your account. In the Hard rock Choice, you can restrict the degree of deposits and bets more a great set time frame. You could do a comparable with so many go out your devote to the site.

Exclusion to the 50% Limit to possess Food

Your nonexempt earnings is $sixty,one hundred thousand and you also weren’t permitted people tax loans. The fundamental deduction try $27,700, and you also had itemized write-offs of $29,two hundred. Inside the 2024, you acquired another recoveries to own number deducted on your own 2023 return. When you dollars a bond, the lending company or any other payer one to redeems it should make you a form 1099-INT should your attention part of the payment you will get are $10 or higher. Setting 1099-INT, field step three is to tell you the interest while the difference in the brand new amount your received and the amount covered the connection.

No-deposit Credit Incentives

We played with the fresh 100 percent free processor and you may have been fortunate to cash out $50 just after rewarding the new wagering needs. I spent the bucks to play 7 Stud Casino poker and you can Aces & Eights, a couple game with 97%+ go back cost. Let’s take a closer look from the our needed $100+ no-deposit bonus rules away from 2025. This type of real money casinos all of the provides grand lobbies full which have many from games along with the luxury of preference. Sportsbook deposit incentives constantly suit your first put to your an excellent sportsbook up to a certain amount. You can then utilize the complimentary added bonus money to help you wager, so when enough time as you match the turnover requirements, it is possible to help you withdraw the brand new payouts from your own added bonus because the real cash.

- You may then discovered loads of totally free spins on one, or occasionally numerous, chosen slot(s).

- Below this type of laws and regulations, your don’t use in your earnings the fresh local rental worth of a house (along with resources) otherwise a specified homes allowance provided to your as part of your pay.

- That you do not use in your revenues accredited withdrawals otherwise distributions which might be money of the regular benefits out of your Roth IRA(s).

- All the laws to own rollovers, told me before lower than Rollover From IRA For the Some other under Antique IRAs, apply to these types of rollovers.

- If you receive betting profits maybe not susceptible to withholding, you might have to shell out projected tax.

If you don’t have fun with a twelve months, the accounting period are a financial year. A consistent fiscal season is actually a twelve-month period one to finishes on the last day of people month but December. A week financial 12 months differs from 52 so you can 53 days and you may constantly comes to an end on the same day’s the fresh day. Your boss is needed to render or post Mode W-dos to you personally no afterwards than January 30, 2025.

Specific on the web sportsbooks additionally require large rollover, that will vary from 2x to help you 25x. All currency you win together with your 31 100 percent free revolves is actually extra for the extra balance once you done your history spin. Together with your winnings you could potentially play any other games during the Betting Club Gambling establishment.

For this specific purpose, any increase to a price transmitted out to the current year you to definitely lead in the deduction or borrowing is regarded as to own quicker the income tax in the earlier season. So you can allege an exception to own accelerated passing professionals made for the a good per diem or other periodic basis, you ought to file Form 8853, Archer MSAs and you will Enough time-Label Worry Insurance rates Agreements, together with your go back. Your don’t need to file Mode 8853 to prohibit accelerated demise benefits paid off based on actual expenses incurred. When the demise advantages is paid to you inside a lump sum payment and other than simply during the regular intervals, use in your earnings just the advantages that are more the amount payable to you personally at the time of the fresh insured man or woman’s dying. Should your benefit payable during the passing isn’t given, you use in your income the advantage repayments which might be far more compared to the introduce value of the brand new money during death.